The Australian resource sector has invested heavily in the mineral resources and energy sector in 2012 and 2013.

The Australian resource sector has invested heavily in the mineral resources and energy sector in 2012 and 2013.

This has created 1000’s of jobs in exploration,�mining,�infrastructure and civil construction projects. What’s next…

The investment timeline for projects is: Exploration > Publicly Announced > Feasibility > Committed > Completed > Production

- 113 projects at the Publicly Announced Stage with a total expenditure of between $121″�171 billion.

- At the end of April 2013 there were 73 projects with a combined capital expenditure spend over their lifetime of $268 billion.

- At the Feasibility Stage the stock of planned capital expenditure is estimated at $232 billion from a total of 174 projects

- In the ten year period 2003 to 2012, around 390 resources and energy major projects progressed to the Committed Stage with a combined value of $394 billion.

- 268 billion are still under construction and not yet complete.

- In the six months to April 2013, 21 projects progressed to the Completed Stage and had a combined value of $15.3 billion.

- By 2015 expenditure is expected to slow down somewhat.

- From 2017 onwards, the stock of committed investment in the mining sector is projected to revert back to levels comparable.

Coal projects remain the highest of all coal and metaliferous mining activity with 19 large projects at the Publicly Announced stage of development, followed by iron ore (18) $35 billion to $56 billion, other commodities (15), Gold (12), LNG, Gas and Petroleum (12).

Iron Ore Mining Projects

Two huge iron ore projects at the Publicly Announced Stage are valued at somewhere above $5 billion; these are the West Pilbara joint venture between Aquila Resources and AMCI ($7.4 billion) and BHP Billiton`s Jinidi project.

There are also two iron ore projects at the Publicly Announced Stage are new to the major projects list;

These include:

- Fortescue Metals Group`s Nyidinghu project ($1.5 billion to $2.5 billion).

- Macarthur Minerals` Moonshine Magnetite project ($2.5 billion to $5 billion investment; and

- The Oakajee Port development in Western Australia remains the largest potential infrastructure project at the Publicly Announced Stage with an estimated value exceeding $5 billion.

There are 21 iron ore projects with a combined value of $47 billion at the Feasibility Stage, presenting a significant investment in the sector. Hancock Prospecting`s Roy Hill ($9.5 billion) and Rio Tinto`s Koodaideri (estimated at around $7 billion) are the two largest iron ore projects in Australia at the Feasibility Stage.

They are considered the largest because of the value they hold in terms of their value as well as the tonnage of output in terms of export potential. The Hancock and Rio projects have the potential to increase the region`s iron ore production by a further 125 Mtpa

Coal Mining Projects

There are 19 coal projects at the Publicly Announced Stage with a combined value of between $24 billion and $28 billion. There are new coal extraction projects like Stanmore Coal`s Belview, Nucoal Resources` Doyles Creek and Cuesta Coal`s Moorlands projects. MacMines Austasia`s Project China Stone mine in the Galilee Basin in Queensland is one of the highest value coal mining projects with a potential annual production of 45 Mt per annum of coal.

Coal projects account for the largest proportion of mining projects in Australia, with a total of 57 projects at the Feasibility Stage and an estimated total of $57 billion in investment capital. They account for 59 per cent of the value of coal projects at the Feasibility Stage in Australia.

The biggest coal projects are located in Queensland`s Galilee Basin. Australian Mining companies with interests in these projects are;

- Adani`s Carmichael Coal Project ($6.8 billion).

- GVK-Hancock`s Alpha and Kevin`s Corner coal mines ($10 billion and $4.2 billion, respectively).

- Waratah Coal`s China First Coal Project ($8 billion); and

- Bandanna Energy`s South Galilee Coal Project ($4.2 billion).Together, these projects account for around 59 per cent of the value of coal projects at the Feasibility Stage.

Infrastructure projects supporting the transportation of coal, remain the main infrastructure projects and account for around 80 per of the value of projects at the Feasibility Stage. These are some of the major infrastructure projects that if implemented, would support the rapid development of the Galilee Basin as a major coal-producing region in Australia.

- Adani`s Abbot Point Terminal (estimated to be around $1.4 billion investment)

- Dudgeon Point (potentially $12 billion),

- GVK`s Abbot Point Terminal 3 development (around $1.8 billion)

LNG Projects

LNG still remains high on the agenda for many mining and exploration companies in Australia. As with multi-billion dollar investments in the sector, there have been adjustments to the start dates of many projects. Four key projects reverted back to the Publicly Announced Stage, which includes the Browse LNG and Sunrise LNG project. This was influenced by global factors and a re-assessment of future demand and profitability, versus capital investment costs.

Although these projects were non-starters at this stage, several other projects progressed to the Feasibility Stage. This has resulted in an increase in the value of investment in LNG projects to around $5.2 billion and $11 billion.

There are 11 LNG, gas and oil projects at the Feasibility Stage with a combined investment value of $72 billion.

Gold and Metaliferous

Gold mining projects have progressed to the Feasibility Stage with some projects moving further towards the Committed Stage, meaning mining activity is rapidly approaching. This is a good indicator for increased mining job growth in the sector. One of the remaining gold projects is the Vista Gold`s Mt Todd project and is the largest with potential output of 260 000 oz per year, valued at somewhere around the $650 million mark.

Major Mining and Gas Projects Under Development

LNG, gas and petroleum projects in Australia have the highest combined capital value of projects at the Committed Stage. The number of LNG projects remains unchanged from October 2012 at 18, however, the value has increased by $10.5 billion to total $205 billion.

One iron ore project, the Western Desert Resources` Roper Bar ($180 million) in the Northern Territory, progressed to the Committed Stage in the six months prior to April 2013.

With a combined value of $14.2 billion, 16 coal mining projects are on the cards. By the end of 2014, 12 of these projects ($12 billion) are scheduled to be completed. The projects include;

- BHP Billiton`s Caval Ridge ($1.9 billion).

- BHP Billiton’s Daunia ($1.6 billion) metallurgical coal mines in Queensland; and

- Anglo American`s Grosvenor Underground thermal coal project ($1.6 billion).

In terms of infrastructure development to support the expansion of the mining and resource sector activity, the value of committed infrastructure projects is $21.1 billion. These projects are scheduled to be completed by the close of 2014;

- Rio Tinto`s Cape Lambert port and rail expansion ($5.2 billion).

- Fortescue Metals Group`s port and rail projects ($4.6 billion) that will, together, provide an additional 160 Mt of export infrastructure for the Pilbara region.

- The Wiggins Island Coal Export Terminal ($2.4 billion); and

- BHP Billiton`s Hay Point Terminal 3 ($2.7 billion), providing an additional 38 Mt of coal export infrastructure capacity in Queensland.

Metaliferous mining projects have contributed to most of the new projects listings at the Committed Stage. At $1.5 billion, MMG`s Dugald River zinc, copper and gold mine was the largest project by value to progress to the Committed Stage and accounted for 44 percent of the new committed project value. Four gold mining projects stand out in the Committed phase of their development.

They are;

- Citigold`s Charters Towers ($246 million).

- Unity Mining`s Dargues Reef ($80 million).

- YTC Resources` Hera project ($74 million); and

- Alkane Exploration`s Tomingley gold project ($116 million).

With significant investment in the Australian oil and gas, coal, and metaliferous mining sector clearly obvious, mining companies are still committed to further development and are confident about global demand for Australian natural resources.

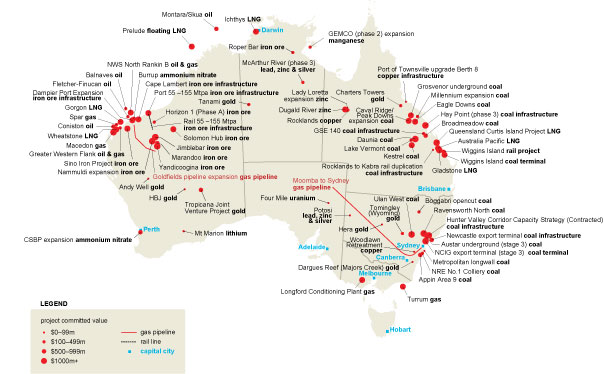

Mining in Australia – Map of Resource Projects in Australia

The Future of Mining in Australia

What we are seeing now is a more calculated approach to development of new projects as the world economy adjusts itself and developing countries reconsider the rapid growth of their economies and infrastructure development.

There is now a focus for the big mining companies and associated contractors to implement sweeping changes across their business in order to remain competitive in the market, whilst increasing productivity output as well as keeping a firm eye on operating costs.

We are seeing an increase in productivity throughput because the big miners like Rio Tinto, BHP and Fortescue Metals Group have invested heavily in automation systems.

These system however, may negate the need for additional workers to operate the equipment. Driver-less trains and automated haul trucks, however, still the need skilled workers who are equipped to help the transition from manual to automated systems.

A new wave of skilled workers

The need to employ a new wave of skilled worker is rapidly approaching. Specialist workers with skills and experience in electronics, computing and electrical systems will be in high demand. The maintenance and servicing of all heavy equipment on mining sites will still be a high priority for mining companies.

The longevity and safe operating practices of equipment can mean operational savings well into the millions of dollars. People looking to prepare for a solid future in the mining and resource sector can benefit from these changes in the industry and start off on the right foot by getting the right training and experience in those areas where jobs will be plentiful.

Get the right advice on what training courses and qualifications you need to have in order to be prepared for the next wave of mining jobs. Contact [email protected] for more information.